Can I deduct mortgage closing costs?

Table of Content

Despite it being a long process, my Agent and other members of the team checked in and provided me comfort when needed. However, if you have an office in your home that you use in connection with a trade or business then you may be able to deduct a portion of the HOA fees that relate to that office. This tool lets your tax professional submit an authorization request to access your individual taxpayer IRS online account. For more information, go to IRS.gov/TaxProAccount. Make a payment or view 5 years of payment history and any pending or scheduled payments. Go to IRS.gov/Account to securely access information about your federal tax account.

Just like with your primary residence, you can deduct things from your rental income like mortgage interest, PMI and taxes. Origination fees are charges paid by the buyer when they get a loan.5 These fees are usually 0.5% to 1% of the value of the loan. The IRS considers origination fees prepaid interest, so they’re tax-deductible in the year of the loan.

Over The Lifetime Of The Mortgage

Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. For a full schedule of Emerald Card fees, see your Cardholder Agreement. If you need help handling an estate, we're here to help. Learn how to file taxes for a deceased loved one with H&R Block. You didn’t borrow funds from your lender or mortgage broker to pay the points. You have the option to pay PMI as a lump sum or to pay it monthly as part of your house payment.

Although closing costs, such as the ones listed below, are not tax deductible, they may increase the cost basis of your home, allowing you to sell your home more quickly. Although new loans do not allow for deduction of mortgage interest , real estate taxes and private mortgage insurance are. You may first allocate amounts paid to mortgage interest up to the amount shown on Form 1098.

More Real Estate Tax Information

If the mortgage is satisfied before its term, no deduction is allowed for the unamortized balance. The buyer treats seller-paid points as if he or she had paid them. If all the tests listed earlier under Exception are met, the buyer can deduct the points in the year paid. If any of those tests aren't met, the buyer must deduct the points over the life of the loan. You can also fully deduct in the year paid points paid on a loan to substantially improve your main home if you meet the first six tests listed earlier.

You and the seller each are considered to have paid your own share of the taxes, even if one or the other paid the entire amount. You each can deduct your own share, if you itemize deductions, for the year the property is sold. To deduct expenses of owning a home, you must file Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Income Tax Return for Seniors, and itemize your deductions on Schedule A .

Private Mortgage Insurance (PMI)

It would include the relevant acquisition costs as well as the property’s cost basis to calculate closing costs. Selling expenses would reduce the value of the item. The purchase price will be reported as it was reported on the 1099-S you received in your closing documents. Capital gains are taxed at a 15% rate, but your taxable income must be at least 15%.

After adding these additional closing costs to your initial basis, you now have an increased adjusted basis. When you buy a home to live in, the only expenses you may deduct for income tax purposes are those for prepayment of interest or any points you pay to obtain a loan. These can be written off as a percentage of your borrowed loan amount. These usually come out to about 1% of the total cost of your mortgage on average.

Closing Costs That Aren’t Tax Deductible on a Home Purchase

Home buyers purchase these points to lower the interest rate on their mortgages, with each point costing 1% of their total loan amount. For instance, one point on a mortgage loan of $200,000 would cost $2,000. Each point typically drops a borrower's interest rate by 0.25%. One point, then, would lower a mortgage interest rate of 5% to 4.75% for the life of a mortgage loan. When you pay points toward your mortgage loan, it is also known as buying down the loan. These fees, paid to your lender, lower the interest rate of your loan.

In most cases, the agency that issues your new MCC will make sure that it doesn't increase your credit. However, if either your old loan or your new loan has a variable interest rate, you will need to check this yourself. In that case, you will need to know the amount of the credit you could have claimed using the old MCC.

When you sell a home, you won't have to pay capital gains taxes on the first $250,000 of your sale if you are single or $500,000 if you’re married. For example, if you’re married and sell your home for a $300,000 profit, you won’t have to pay any capital gains taxes on it. Points can pay off in lower interest costs throughout the life of a loan. The IRS allows you to deduct the full amount of your points in the year borrowers pay for them. To claim this deduction, your mortgage must be used to buy or build your primary residence.

You can’t ever get away from taxes, and the tax man will take his cut at your closing too. Depending on where you live, you’ll usually have to pay some state or local property taxes. This could be a portion of the current year’s taxes or the full amount . Credit report, appraisal and homeowners insurance fees cannot be added to your home’s cost basis, nor are they deductible.

The term “points” includes loan placement fees that the seller pays to the lender to arrange financing for the buyer. To be deductible, the interest you pay must be on a loan secured by your main home or a second home, regardless of how the loan is labeled. The loan can be a first or second mortgage, a home improvement loan, a home equity loan, or a refinanced mortgage. At least 80% of the corporation's gross income for the tax year was paid by the tenant-stockholders. For this purpose, gross income means all income received during the entire tax year, including any received before the corporation changed to cooperative ownership.

What can you do to get some tax benefit from these nondeductible expenses? The best strategy is to have the seller pay these expenses and add the cost to the price of the home. This will increase the home's basis and reduce any taxable profit when you sell. Meantime, the seller treats these costs as selling expenses that reduce gain from the sale.

Home Purchase Costs You Can't Deduct or Add to Tax Basis

The following are some of the settlement fees and closing costs that you can include in the original basis of your home. The basis of a home you bought is the amount you paid for it. This usually includes your down payment and any debt you assumed.

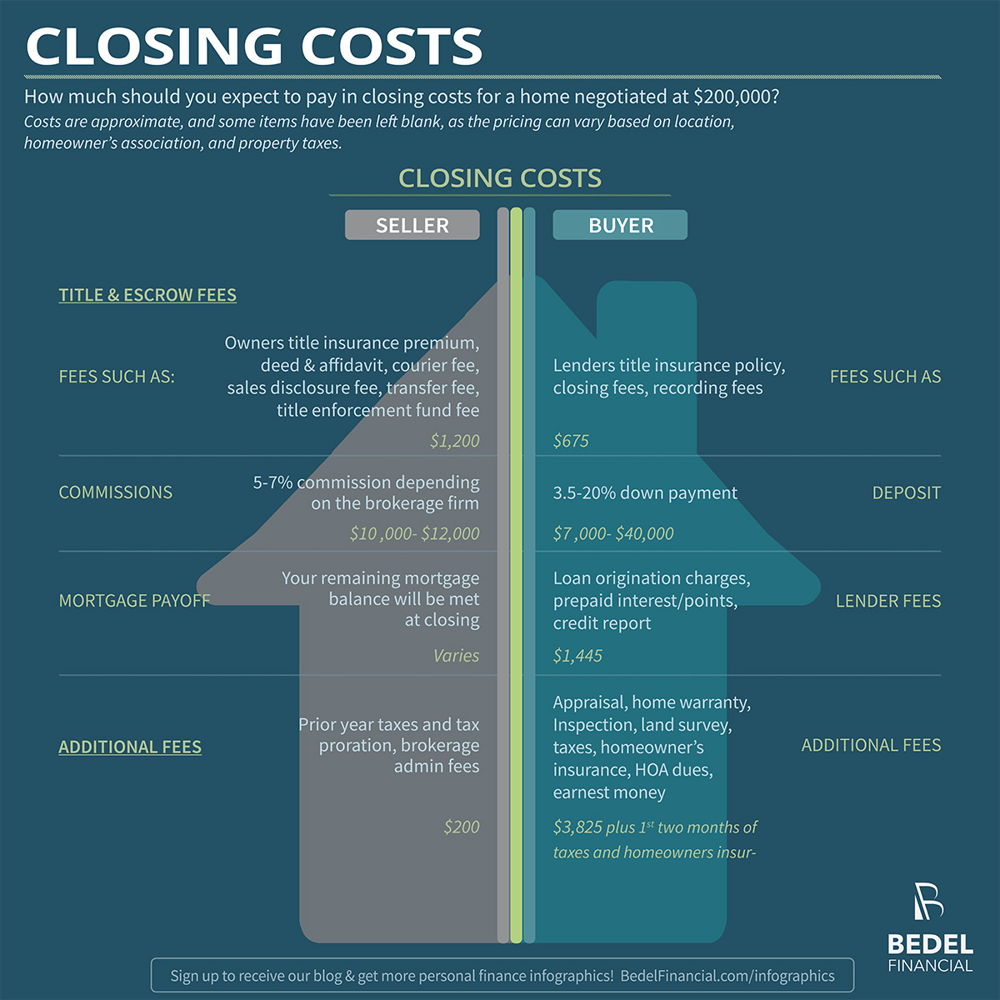

You may then use any reasonable method to allocate the remaining balance of the payments to real property taxes. However, you aren’t required to use this special method to figure your deduction for mortgage interest and real estate taxes on your main home. The closing costs of a home range from 3% to 6% of the purchase price. If you buy a $200,000 house, you may have to pay between $6,000 and $12,000 in closing costs. A mortgage closing fee may differ depending on the type of loan, lender, and state.

Comments

Post a Comment